how to find out why i have a tax levy

Dont Let the IRS Intimidate You. A tax levy itself is a legal means of seizing taxpayer assets in lieu of previous taxes owed.

4 7 Taxes And Subsidies Principles Of Microeconomics

We can help protect your assets and negotiate a settlement.

. Through a tax lien the IRS legally states that they have the right to claim your property due to unpaid tax debt. Ad Stop Tax Levy. Yes the IRS wants to hear from you.

Get Free Competing Quotes From Tax Levy Experts. IRS Levies Expert Can Help. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

Immediate Permanent Solutions. A lien is a legal claim against property to secure payment of the. The Department may levy against your wages salaries bonuses commissions and other compensation from your employer.

What is a Levy. Ad Dont Face the IRS Alone. Ad Take advantage of current tax programs before its too late.

A state tax levy is a collection method that tax authorities use. A tax levy is a legal seizure of your property by the IRS or state taxation authorities. A wage levy requires your employer to deduct a specified.

Levies are different from liens. IRS Levies Expert Can Help. Wisconsin Department of Revenue.

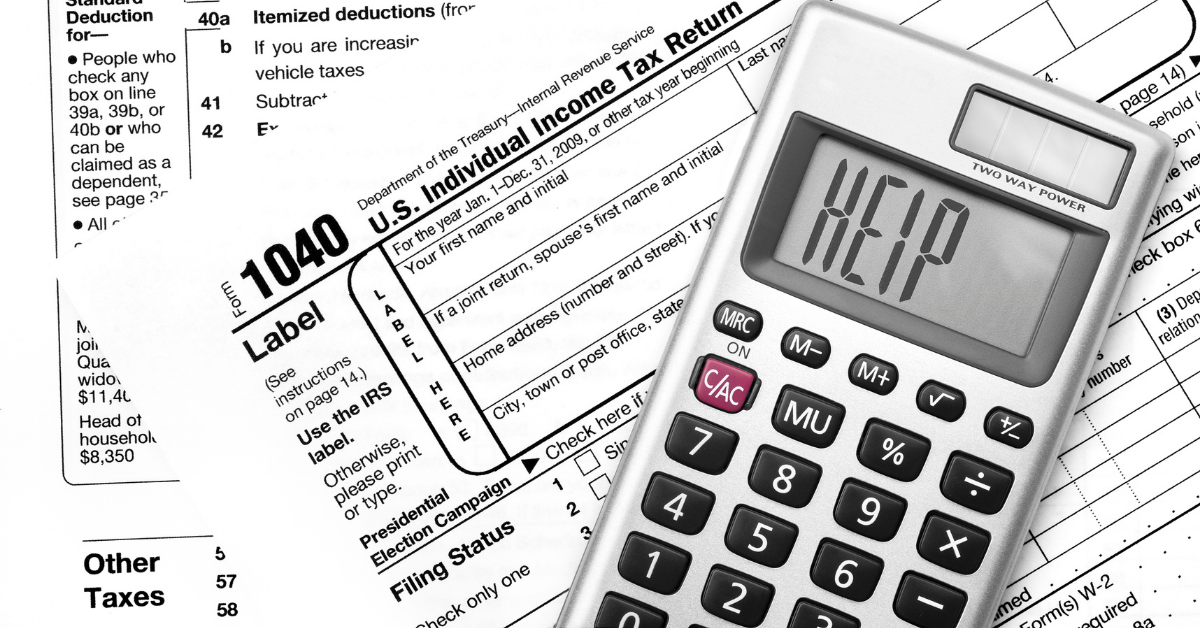

How do you find out if you have an IRS levy. Learn How to Find Out if You Have a Tax Lien. Apprenticeship Levy is an amount paid at a rate of 05 of an employers annual pay bill.

If you do not owe money for. If they have written you a letter they want a response. How to Remove a Tax Lien.

Get Free Consult Quote. Verify that the lien is legitimate. Government agencies can make errors on these issues.

If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. C all the number on your billing notice or individuals may contact the IRS at 1-800-829-1040. If an IRS Revenue Officer has called you or stopped by your.

As an employer you have to pay Apprenticeship Levy each month if you. Ad Dont Face the IRS Alone. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

A levy is a legal seizure of your property to satisfy a tax debt. A tax levy is not the same as a tax. Dont Let the IRS Intimidate You.

Get A Free IRS Tax Levy Consultation. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Get A Free IRS Tax Levy Consultation.

It is different from a lien while a lien makes a claim to your assets. The IRS or State can levy your property if you have delinquent taxes owed and dont take action to. File any outstanding tax returns.

Ad Stand Up To The IRS. Get Free Competing Quotes From Tax Levy Experts. Trusted Affordable Reliable Professionals That Can Stop Your Tax Levy Today.

A tax levy is a collection procedure used by the IRS and other tax authorities such as the state treasury or bank to settle a tax debt that you owe to them. It can garnish wages take money in your bank or other financial account seize and sell your vehicle. Businesses may contact us at 1-800-829.

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Tax Levy What It Is And How To Stop One Nerdwallet

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Stop A Tax Levy At Ooraa Irs Taxes Tax Debt Tax Payment Plan

What Is A Notice Of Levy And What Happens When You Receive One Levy Associates

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Tax Levy Understanding The Tax Levy A 15 Minute Guide

What Is A Tax Levy Guide To Everything You Need To Know Ageras

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Hong Kong S Tax System Explained Why Levies Are So Low How It Competes With Singapore And Why It S Both Out Of Date And Ahead Of Its Time South China Morning Post

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)